Reconsidering Henry George

The New Republic, December 11, 1971

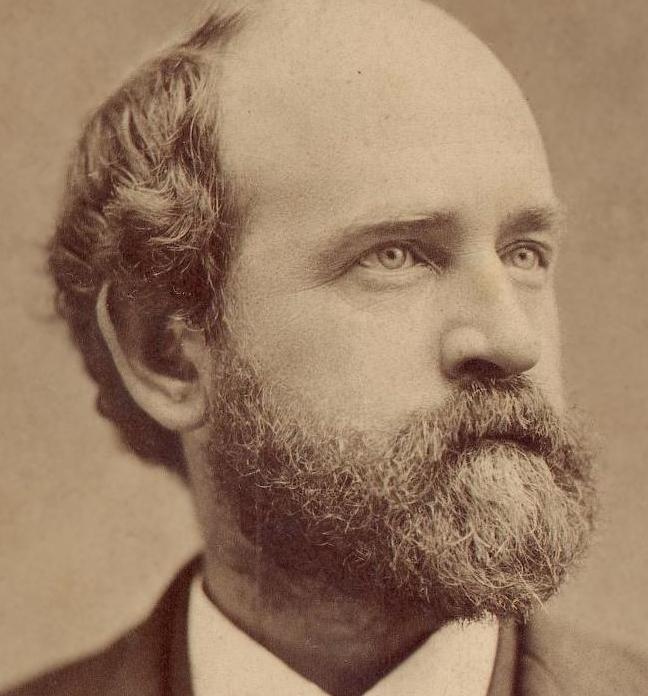

WHEN Henry George’s Progress and Poverty was first published by Appleton in 1880, it became a worldwide best-seller almost at once. Reviewers hailed it as one of the most remarkable books of the century. Newspapers ran portions of it as a serial. Cheap paperback editions were printed in both America and England. Foreign editions were published in more than a dozen languages. Within a few years more than two million copies of the book had been sold, and many more than that number of people were familiar with its ideas. Henry George’s popularity was such that, when the Labor Party drafted him in 1886 to run for mayor of New York City, he finished second in a three-way race, out-polling Theodore Roosevelt but losing to the Tammany candidate. When George died a decade later in the heat of another New York mayoralty campaign, more than a hundred thousand people passed his bier to pay respect, and the funeral procession through the city streets was compared to Lincoln’s.

Yet such are the vagaries of intellectual fame that Henry George today is little more than a footnote in the history and economics texts. When he is remembered at all it is as a single-taxer, a semi-crack-pot with a cure-all for society’s ills. His name is magic only in the dozen or so Henry George schools that have sprung up to perpetuate his teachings.

This is a great pity, for Progress and Poverty is a monumental work that deals only briefly with the single tax. No other economics book that I have read possesses the lucidity, grace or compassion of George’s classic. And while there are faults in George’s reasoning, and much of what he says has been blunted by the passage of time, what strikes the modern reader is how extremely pertinent this book remains.

The fundamental question posed in Progress and Poverty is as the title implies: Why, in the midst of ever-growing plenty, does poverty persist and indeed flourish? Why, “amid the greatest accumulations of wealth, do men die of starvation, and puny infants suckle dry breasts?” This paradox, while worldwide, is nowhere more evident than in the United States, where “almshouses and prisons are as surely the marks of material progress as are costly dwellings, rich warehouses, and magnificent churches.”

On the American frontier, George observed, there was neither great wealth nor grinding poverty; all men worked hard and were rewarded with material blessings in approximately equal proportion. Yet as industry progressed and cities rose, so too did the disparity of income and opportunity. New York, the greatest city of all, swarmed with paupers, and San Francisco, where George was a printer and newspaperman, was not far behind. Far from alleviating human want, material progress was augmenting it. “It is as though an immense wedge were being forced, not underneath society, but through society. Those who are above the point of separation are elevated, but those who are below are crushed down.”

To discover and then eradicate the root cause of this phenomenon was, for George, the paramount task of political economy. Clearly, he reasoned, the cause must lie somewhere in the mechanics of the distribution of wealth. At about the same time that Karl Marx was placing the blame on the expropriation by capitalists of the surplus value of labor, George’s analysis was leading to a different conclusion.

GEORGE’S BASIC ARGUMENT can be briefly summarized. Wealth is produced by a combination of three factors: land, capital and labor, the returns on each being, respectively, rent, interest and wages. As the productive capacities of labor and capital increase, so too does the value of the land upon which they must operate. Rent (defined as payment for the use of bare land, as opposed to payment for the use of buildings) therefore rises as fast as wages and interest. Indeed, rent rises so fast that it swallows up all increases in the value of production, thus making landowners, rather than workers or capitalists, the sole (and wholly undeserving) beneficiaries of progress. “The great cause of the inequality in the distribution of wealth, is inequality in the ownership of land,” George concluded, and this led inexorably toward his famous remedy: the transformation, through a tax on rent, of individual land ownership into common land ownership.

George’s economic reasoning was buttressed by an excursion into the realm of social ethics, much of which is strikingly resonant with what ecologists are saying today. The only private property that is legitimate, he contended, is that which is the product of labor; as a man belongs to himself, so his labor, when put in concrete form, belongs to him and no other. The gifts of nature, on the other hand, are given to all indiscriminately, and no man has a right to possess what is equally the birthright of his fellows. When, because of population growth or the advance of civilization, a particular piece of land or natural resource rises in market value, that rise is not the result of any one man’s exertions, and cannot rightfully be appropriated by any one man. To tax that unearned rise in value — indeed to confiscate it — is therefore just. To tax the fruit of a man’s labor, while sometimes necessary, is essentially unjust.

George’s economic reasoning has flaws. For example, while some increase in the value of production is appropriated by the owners of land, not all of it is thusly stolen. Private land ownership isn’t the only cause of poverty amidst plenty, and taxation of land values, while reasonable and just, cannot by itself bring abundance to all.

And yet, despite these and other weaknesses in George’s arguments, and despite the flood of economic writing we have had in this century, I am convinced that American economic thought has, in a most important respect, regressed since Progress and Poverty. The great fascination of latter-day American economists has not been the distribution of wealth. It has been, to use the fancy term, macroeconomics: the national-scale problems of growth, inflation and unemployment, and how to use government policies to control them. The present mechanisms for distributing wealth are accepted almost worshipfully. All that is necessary, says the conventional economic wisdom, is to iron out the business cycle and increase gross domestic product. Income distribution will then take care of itself, mainly through the trickle-down process. If, for any reason, some Americans don’t get themselves aboard the gravy train, they can be kept alive (barely) through welfare.

The failure of modern economics to question the distributive system has been accompanied by a parallel brainwashing of the general public. In George’s day, millions knew the underlying cause of poverty was not Americans’ unwillingness to toil, but the fact that Robber Barons were squeezing every possible penny out of the hides of working men. Today the monopolists are subtler, the unions stronger, and Madison Avenue more ingenious. The Horatio Alger myth, with all its corollaries, is more firmly entrenched than ever. It’s not the system that creates economic inequality, says the myth, it’s personal inadequacies: lack of education, sloth, a defective family structure. Improve the individual and you eliminate poverty.

Henry George disposed of such theories swiftly. “If one man work harder, or with superior skill or intelligence than ordinary, he will get ahead; but if the average of industry, skill or intelligence be brought to the higher point, the increased intensity of application will secure but the old rate of wages, and he who would get ahead must work harder still…The fallacy is similar to that which would be involved in the assertion that every one of a number of competitors might win a race. That any might is true; that every one might is impossible.”

WHEN THE WAR on Poverty arrived in the early 1960s and raised the same question posed by George in 1880, it came up with all the wrong answers. Give “them,” the poor, job training; give others, the bureaucrats, jobs; but don’t for a moment tamper with the tax laws or anything that might fundamentally alter the distributive system. Now, five years from the date proclaimed by Sargent Shriver as the millennium by which all poverty was to disappear, there are more poor people in America than before the War on Poverty began.

The great wonder is not that American economists have failed to resolve the poverty-amidst-plenty enigma (for it is a highly cure-resistant paradox) but that they have so easily been diverted from the quest. I am certain that Henry George, were he alive today, would not be nearly so complacent. It outraged him in 1880 that “New York alone spends over seven million dollars a year” on official charity; imagine his sense of injustice today! Perhaps, in surveying our high-technology economy, he would perceive the insufficiency of his land value tax approach; perhaps not. In any case he would assuredly be asking the right questions.

American interest in Progress and Poverty ought to revive. Some vital questions might then be reinjected into our economic debate—questions such as whether land, and even capital, are public resources, and thus ought not to be monopolized for the profit of a few; whether income earned through labor ought to be taxed at the same, or even a lower rate, as income not so earned (the reverse is currently the case); and where, in the economic system, the diversions occur that prevent an equitable distribution of wealth.

In his preface to Progress and Poverty, George wrote that what he tried to do was to reconcile the laissez faire ideals of liberty and individualism with the socialist goal of economic justice — as he put it, “to unite the truth perceived by Smith and Ricardo to the truth perceived by Proudhon and Lasalle.” Ninety years later that remains an unfinished task. American political economy should get on with it.

Free distribution with attribution

Free distribution with attribution